Como explorar a Lei do Bem em indústrias

Na busca por inovações, competitividade e produtividade, as organizações têm adotado medidas para redução de gastos, otimização e aprimoramento de etapas e processos. O investimento em atividades de Pesquisa e Desenvolvimento (P&D) reflete o crescimento da competitividade do Brasil, ganhando incentivo fiscais para isso.

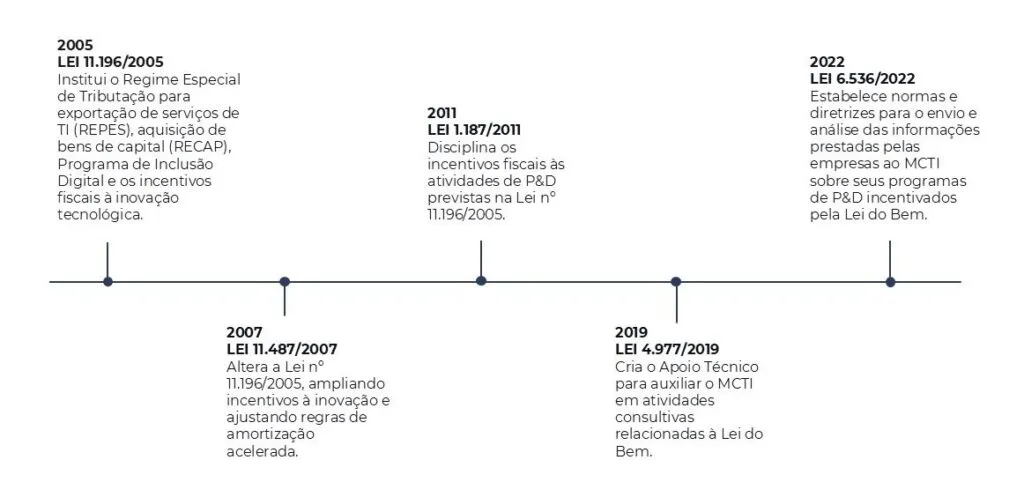

A Lei do Bem (n°11.196/2005), foi criada com o intuito de estimular as atividades de PD&I (Pesquisa, Desenvolvimento e Inovação Tecnológica) nas empresas brasileiras, aplicando-se deduções no Imposto de Renda e na Contribuição Social sobre o Lucro Líquido (CSLL). Para maior compreensão:

Os benefícios concedidos por meio do art. 19 da Lei 11.196/2005 incluem:

I – Dedução da soma dos dispêndios de custeio nas atividades de Pesquisa, Desenvolvimento e Inovação – PD&I no cálculo do IRPJ e CSLL, nos seguintes percentuais:

- Até 60%, via exclusão;

- Mais 10%, na contratação de pesquisadores para PD&I (Incremento inferior a 5%);

- Mais 20%, na contratação de pesquisadores para PD&I (Incremento superior a 5%);

- Mais até 20%, nos casos de patente concedida ou registro de cultivar.

II – Redução de 50% do IPI na aquisição de bens destinados à PD&I;

III – Depreciação Acelerada Integral de bens novos destinados à PD&I;

IV – Amortização Acelerada de bens intangíveis destinados à PD&I;

V – Redução a zero da alíquota do Imposto de Renda Retido na Fonte (IRRF) nas remessas de recursos financeiros para o exterior destinadas ao registro e manutenção de marcas, patentes e cultivares.

Para se beneficiar, as empresas precisam estar no regime de tributação pelo Lucro Real e manter regularidade fiscal. Além disso, também é necessário apresentar relatórios detalhados ao Ministério da Ciência, Tecnologia e Inovação (MCTI) para comprovar as atividades, que devem abranger:

Pesquisa básica dirigida: trabalhos executados com o objetivo de adquirir compreensão de novos fenômenos, com vistas ao desenvolvimento de produtos, processos ou sistemas inovadores;

Pesquisa aplicada: trabalhos executados com o objetivo de adquirir novos conhecimentos, com vistas ao desenvolvimento ou aprimoramento de produtos, processos e sistemas;

Desenvolvimento experimental: trabalhos delineados a partir de conhecimentos pré-existentes, visando a comprovação ou demonstração da viabilidade técnica ou funcional.

Transformação interna: PD&I e Lei do Bem

O setor de softwares é um dos que mais se beneficia dessa lei. Em 2022, cerca de 494 empresas utilizaram os incentivos fiscais, resultando em uma renúncia fiscal de R$ 714 milhões. Esses recursos foram majoritariamente direcionados para investimentos em desenvolvimento tecnológico e inovação, com destaque para projetos de alto risco, como soluções baseadas em inteligência artificial e automação.

Ainda que a aplicação de projetos envolvendo inteligência artificial e automação pareça mais evidente em empresas de software, indústrias de outros setores também podem se beneficiar dessas inovações. A Lei do Bem permite que atividades não estejam necessariamente vinculadas ao produto comercializado, mas sim a qualquer processo que represente ganho tecnológico.

Isso abre espaço para que indústrias de manufatura, como as dos segmentos de papel e celulose, alimentício, explorem o uso de softwares inovadores em seus processos internos ou intermediários. Tais softwares podem incorporar tecnologias emergentes, como inteligência artificial, internet das coisas (IoT) ou soluções criativas que aumentem a eficiência, a automação e a produtividade das operações.

No entanto, softwares tendem a ser aprovados mais facilmente na Lei do Bem devido à sua adaptabilidade e impacto na competitividade organizacional. Indústrias podem implementar projetos que otimizem logística, automação, gestão ou análise de dados. Por exemplo, rastreamento de consumo energético, quando personalizado para atender à metodologia e indicadores da organização, podem ser, de fato, inovadores.

Esse incentivo permite que empresas transcendam os limites tradicionais de inovação, aproveitando softwares não apenas como produto, mas como ferramenta para transformação interna. Isso torna a Lei do Bem uma oportunidade crucial para organizações em busca de diferenciação competitiva e eficiência operacional.

Aplicação da Lei do Bem em indústrias de manufatura

A empresa Melhoramentos Florestais, focada na produção de celulose, utilizou os incentivos da Lei do Bem para desenvolver embalagens sustentáveis feitas de fibra de celulose. Com o apoio da GT Group, a empresa conseguiu construir uma fábrica inovadora em Minas Gerais, com um investimento inicial de R$ 40 milhões. O projeto não só promoveu a sustentabilidade, mas também gerou empregos e fortaleceu a cadeia produtiva nacional.

A Klabin, produtora e exportadora de papéis para embalagens e soluções sustentáveis do Brasil, também ganha destaque como empresa inovadora. A companhia desenvolve projetos de softwares internos que se enquadram na Lei do Bem, incentivando a pesquisa e o desenvolvimento tecnológico. Um dos projetos de destaque está relacionado à digitalização e automação dos sistemas de embalagens, desenvolvido em parceria com a ST-One.

O setor de Mecânica e Transporte, enfrenta constantes desafios econômicos, políticos e tecnológicos para manter sua competitividade nacional e internacional. Nesse contexto, a inovação tecnológica desempenha um papel essencial na modernização e fortalecimento do setor, sendo refletida na contínua adesão aos incentivos fiscais da Lei do Bem.

No entanto, apesar da Lei do Bem ser extremamente positiva para as organizações que desejam se posicionar por meio da Pesquisa e Desenvolvimento, existem desafios para sua aplicação. Muitas empresas relatam dificuldades com a quantidade de documentação exigida, falta de clareza nos critérios e produção de formulários muito específicos, dificultando .

Existem diversas formas de desenvolver um projeto inovador e, para superar os desafios envolvidos nesse processo, uma alternativa eficaz é contar com empresas parceiras — desde consultorias especializadas até fornecedores de recursos tecnológicos — que possam apoiar a concepção e a execução dos projetos.

Saiba mais sobre a ST-One.