A indústria global de protetores solares tem passado por uma transformação significativa, impulsionada por fatores como o aumento da radiação ultravioleta, a crescente conscientização sobre os riscos do câncer de pele e a demanda por produtos mais sustentáveis e tecnologicamente avançados. Em 2025, o mercado já ultrapassa os 20 bilhões de dólares, com projeções que indicam um crescimento contínuo até 2029, quando deve atingir 24 bilhões.

O Brasil se destaca como o maior mercado da América Latina e o terceiro maior do mundo, sustentado por sua alta exposição solar, políticas públicas de saúde e uma indústria cosmética inovadora que investe em fórmulas biodegradáveis e adaptadas à diversidade de tipos de pele. Empresas como a Vitalife Indústria de Cosméticos têm investido em estratégias de expansão, especialmente no Nordeste, com foco em distribuição eficiente e adaptação ao comportamento do consumidor local.

O restante da América Latina apresenta crescimento constante, impulsionado pela urbanização, aumento da renda e valorização do autocuidado, enquanto marcas locais e internacionais disputam espaço com estratégias que combinam acessibilidade e apelo ecológico.

Na América do Norte, o mercado é altamente regulado e sofisticado, com forte preferência por protetores minerais e produtos multifuncionais, além de uma crescente adesão ao movimento clean beauty. Globalmente, a indústria caminha para uma convergência entre eficácia, segurança e sustentabilidade, com destaque para o uso de ingredientes como óxido de zinco e dióxido de titânio, e o desenvolvimento de protetores que oferecem proteção contra a luz azul, poluição urbana e envelhecimento precoce.

De acordo com a Universidade Federal de Uberlândia (UFU), as projeções até 2029 indicam um crescimento de 60% no Brasil, 43% na América Latina, 40% na América do Norte e 40% no mercado global, consolidando a fotoproteção como um dos pilares da indústria cosmética contemporânea.

Linha do tempo de Crescimento projetado até 2029 (Valores relativos – indústria de Protetor Solar)

Análise de Dados aplicada à produção de Protetores Solares

A integração de um processo robusto de ciência de dados em todas as etapas da cadeia produtiva é essencial para garantir a eficiência e a inovação na indústria de protetores solares. Em uma linha de produção, por exemplo, sensores instalados em misturadores industriais possibilitam o monitoramento preciso do uso de insumos, assegurando que a homogeneidade da mistura esteja dentro dos parâmetros definidos. A análise desses dados permite avaliar o desempenho dos ingredientes em tempo real, otimizando a formulação e reduzindo variabilidades entre lotes.

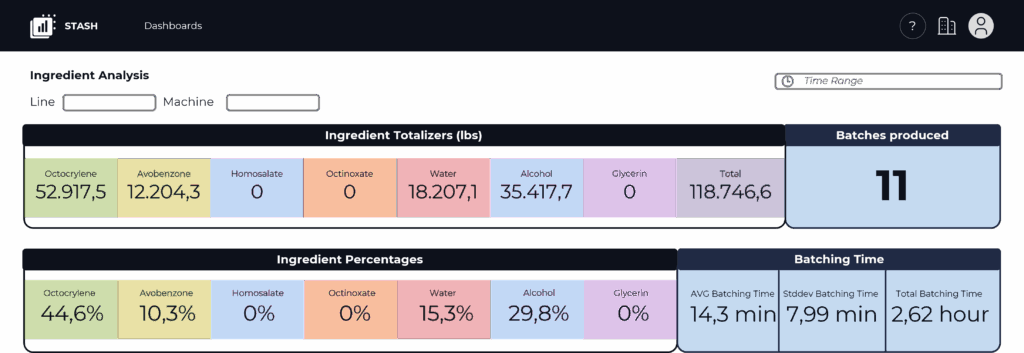

Gráficos como o da figura 1 ilustram a totalização em unidade de massa ao longo do tempo, a porcentagem de cada ingrediente em relação ao total entregue, além de estatísticas como média, desvio padrão e tempo total de produção por batelada.

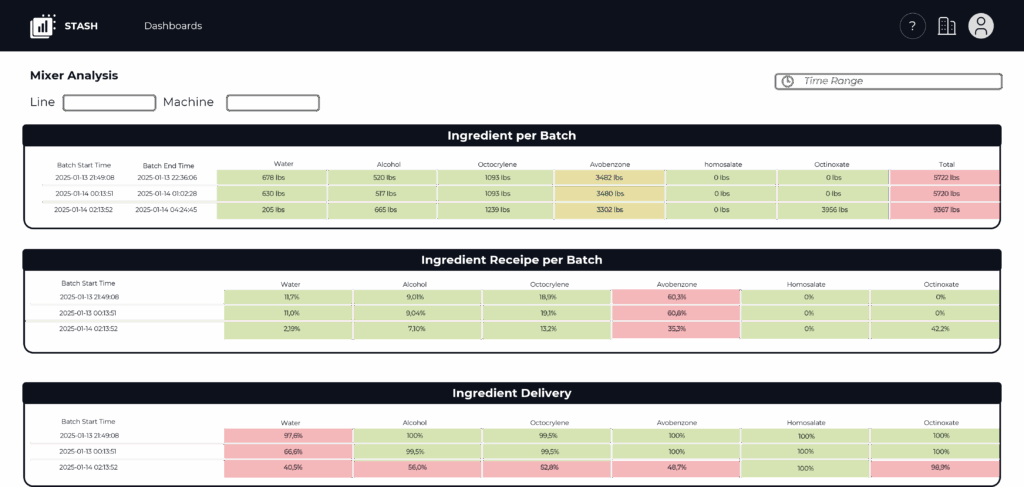

Já a figura 2 aprofunda a análise por batelada, detalhando a quantidade de cada ingrediente entregue, sua proporção relativa e o desvio em relação ao valor esperado (setpoint), fornecendo uma visão crítica da consistência do processo. Em paralelo, sensores em tanques de armazenamento monitoram níveis e previnem contaminações, garantindo a integridade dos insumos.

Na etapa de envase, a análise de eficiência das máquinas considera tanto a velocidade quanto a precisão, reduzindo desperdícios e assegurando a padronização do volume final. Em um setor altamente regulamentado como o de produtos de saúde e beleza, conformidade com normas como a ISO 9001 é mandatória, o que exige a implementação de análises rigorosas de qualidade.

Entre elas, destacam-se os testes de eficácia por espectrofotometria in vitro, que validam o fator de proteção solar declarado; os estudos de fotoestabilidade, que garantem a manutenção da eficácia após exposição à luz solar; e as análises químicas e microbiológicas, que asseguram a ausência de contaminantes.

A convergência entre automação, ciência de dados e controle de qualidade posiciona a indústria de protetores solares em um novo patamar de excelência, onde inovação e conformidade caminham lado a lado.

Eficiência Operacional Sustentável na Indústria de Protetores Solares

Análises que integram performance e sustentabilidade na produção em massa de protetores solares representam uma fronteira estratégica da indústria cosmética, especialmente em um cenário de crescente exigência regulatória e consciência ambiental. Essas análises não apenas otimizam o uso de recursos e reduzem impactos ambientais, mas também garantem a consistência e a eficácia dos produtos, aspectos críticos em um setor altamente regulamentado.

Na prática, a sustentabilidade na linha de produção de protetores solares começa com o monitoramento inteligente de insumos, como óleos, filtros UV e emulsificantes. Um estudo da Springer (2023) aponta que a otimização do tempo de mistura e da temperatura de processo pode reduzir significativamente o consumo de energia sem comprometer a estabilidade do produto final. Outro ponto relevante é o uso de embalagens sustentáveis, como tubos recicláveis ou biodegradáveis, que também entram nas métricas de sustentabilidade da produção. A análise do ciclo de vida (LCA) dos produtos tem sido cada vez mais utilizada para avaliar o impacto ambiental desde a extração dos ingredientes até o descarte da embalagem.

Do ponto de vista acadêmico, revistas como o Journal of Materials Engineering and Performance e o International Journal of Environmental Science and Technology têm publicado estudos que exploram a relação entre engenharia de processos, sustentabilidade e desempenho de produtos cosméticos. Esses estudos destacam a importância de integrar dados de diferentes áreas produtivas — como formulação, envase, utilidades e logística — para criar modelos preditivos que otimizem o uso de recursos e reduzam emissões e resíduos.

Em resumo, a produção sustentável de protetores solares depende de uma abordagem sistêmica, baseada em dados, que conecta variáveis operacionais com métricas ambientais. Essa integração não só melhora a performance industrial, mas também fortalece a reputação da marca e sua aderência às exigências de consumidores e órgãos reguladores.

Saiba mais sobre a ST-One.